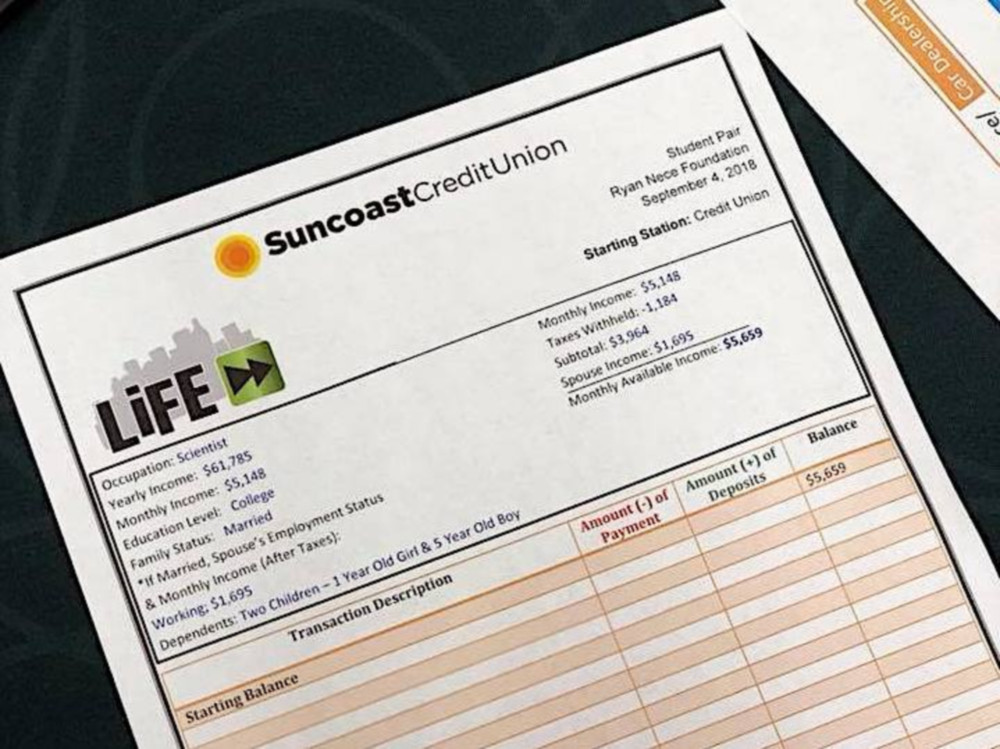

We, the junior class of the Ryan Nece Foundation, met most recently at the Suncoast Credit Union to discuss financial responsibility, learn about the contrasts between credit unions and banks, and share our thoughts on topics such as systemic poverty and student debt. We developed our financial literacy through the Life Fast Forward simulation, in which we were handed a bio with a given education, career, monthly salary, and family, and asked to make that salary last the entire month, figuring out how to make it cover the various expenses of adulthood. We maneuvered stations such as childcare, transportation, clothing, groceries, insurance, technology, and utilities, forced to reconcile our budget with the costs of living. In many cases, this meant turning down the fancy car or big house to buy groceries or pay for utilities.

One aspect of the game that stood out to me was the effect that education had on one’s career and quality of life. Those with a college education tended to have more lucrative careers, as well as more financial options. Those with only a high school education, however, had to stretch their budgets tighter, buy things on credit, and pick up part-time jobs. They were also limited on the size of their families; many could simply not afford the costs of raising a child. Through Life Fast Forward, we learned the fine art of being financially responsible adults; budgeting, saving, prioritizing, and planning. I think I can speak for the rest of my class when I say that I’m very grateful to the Suncoast Credit Union for teaching us these lessons in advance, so as to avoid making such financial mistakes in real life.

– Taylor Johnson